Ola group usa – CDs

Certificates of Deposit (CDs)

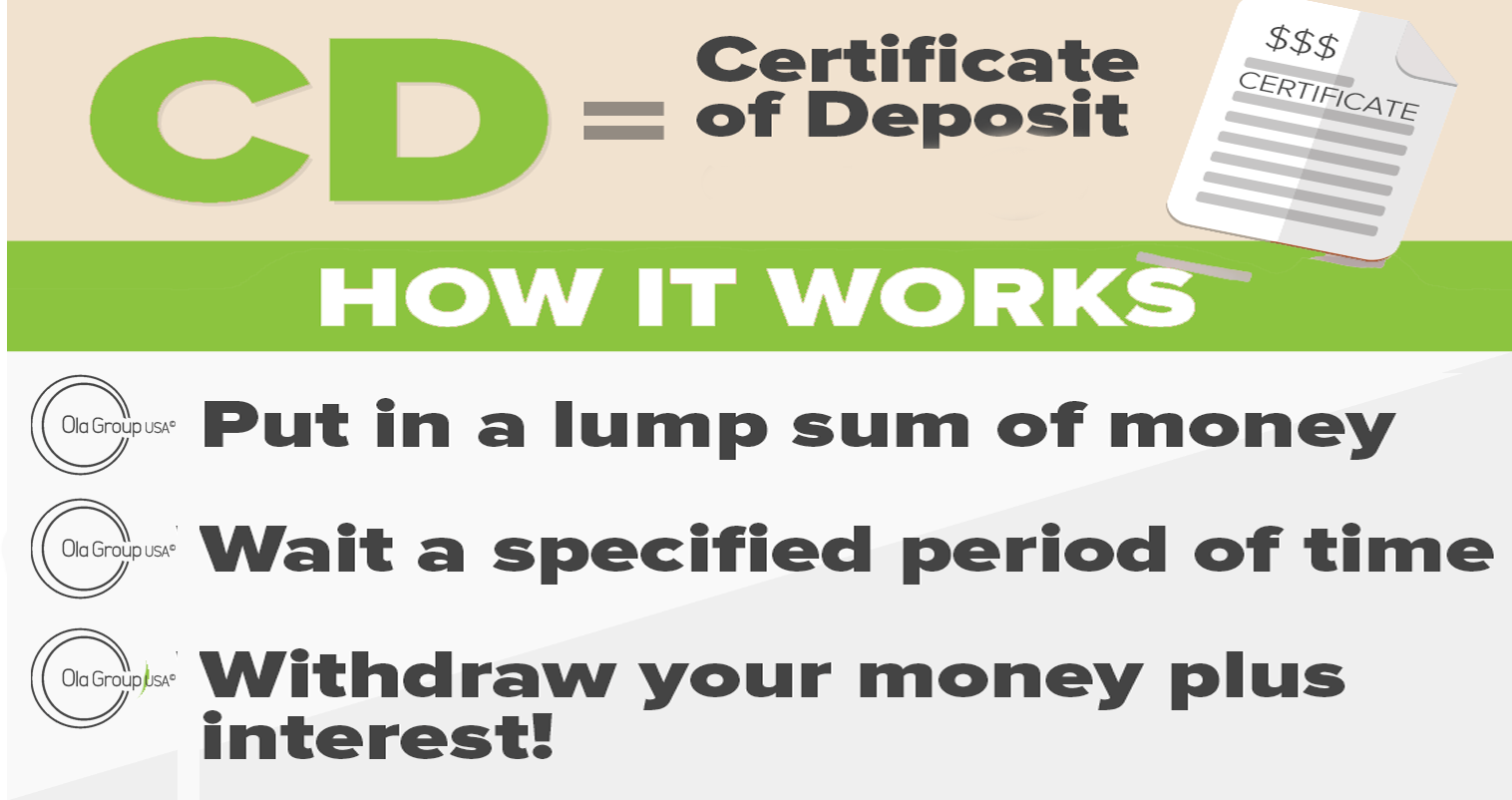

What is a Certificate of Deposit?

Certificate of Deposit (CD) investments involve depositing a fixed amount of money with a bank or financial institution for a predetermined period, typically ranging from a few months to several years. In return, the investor receives a fixed interest rate, which is typically higher than that of a regular savings account. One key advantage of CDs is their low-risk nature, as they are typically insured by the government up to certain limits, providing investors with a level of security. Additionally, CDs offer a predictable rate of return and are ideal for individuals seeking to preserve capital while earning a modest yield. However, one drawback of CDs is their lack of liquidity, as withdrawing funds before the maturity date often results in penalties or loss of accrued interest. Moreover, the fixed interest rate means investors may miss out on potentially higher returns if interest rates rise during the CD's term. Overall, CDs can be a suitable option for conservative investors looking for a safe and predictable way to grow their savings over a defined period.

A Simple Low Risk Investment

Why invest in a cerficate of deposit?

- A certificate of deposit (CD) is considered a low-risk investment where you deposit a certain sum of money with a bank for a predetermined period and earn interest on it. At the end of the term, you receive your initial investment along with the agreed-upon interest. Typically, longer loan periods offer higher interest rates. While CDs offer a low-risk option, they also provide lower potential returns. The primary way to profit from CDs is through the interest earned over the deposit's duration, making them suitable for long-term savings. They are deemed secure investments because they are FDIC-insured up to $250,000, mitigating risks even if the bank fails. However, early withdrawals can result in substantial penalties, so it's essential to ensure you won't need the funds during the CD term.

Overall, bonds offer a range of benefits that can complement other investments and help investors achieve their financial goals with varying levels of risk and return.

Get to know the ups and downs of CDs

Although this type of investment is fairly low risk, it offers a fixed interest rate and requires a predetermined investment period.

Benefits

Low Risk: CDs are considered very low-risk investments as they are typically FDIC-insured up to $250,000, providing security for deposited funds.

Fixed Interest Rates: CD investors benefit from predetermined interest rates, providing predictability in returns over the investment period.

Diversification: CDs offer a way to diversify investment portfolios by providing a stable, fixed-income component alongside riskier assets.

Long-Term Savings: CDs are suitable for long-term savings goals, offering a disciplined approach to saving with potential for modest returns.

Risks

Limited Liquidity: Early withdrawals from CDs often result in penalties, limiting liquidity and access to funds before the maturity date.

Opportunity Cost: CDs may offer lower returns compared to other investments, potentially missing out on higher returns available in the market.

Fixed Terms: CD investors are locked into fixed terms, limiting flexibility and the ability to take advantage of changing market conditions.

Inflation Risk: The fixed interest rates offered by CDs may not keep pace with inflation, resulting in diminished purchasing power over time.

Ola Group usa – Get Started

Investment Solutions Tailored for Your Unique Needs

Crafting Personalized Investment Strategies: Tailored Solutions for Your Distinct Financial Goals